We Serve These Clients

Advisory Firms, Consultants, Sellers and Buyers

We Help Create, Protect and Optimize Enterprise Value.™

Wealth Advisors - We help prepare the business for sale. The Investment Banker sells the business. Then, the Wealth Advisors invests the proceeds. An Owner/CEO who is “ready” with an attractive business greatly increases the odds that the business will find a serious buyer. We work with Owners/CEOs to approach the exit strategy with the same focus and drive that helped to build their businesses. > Learn More

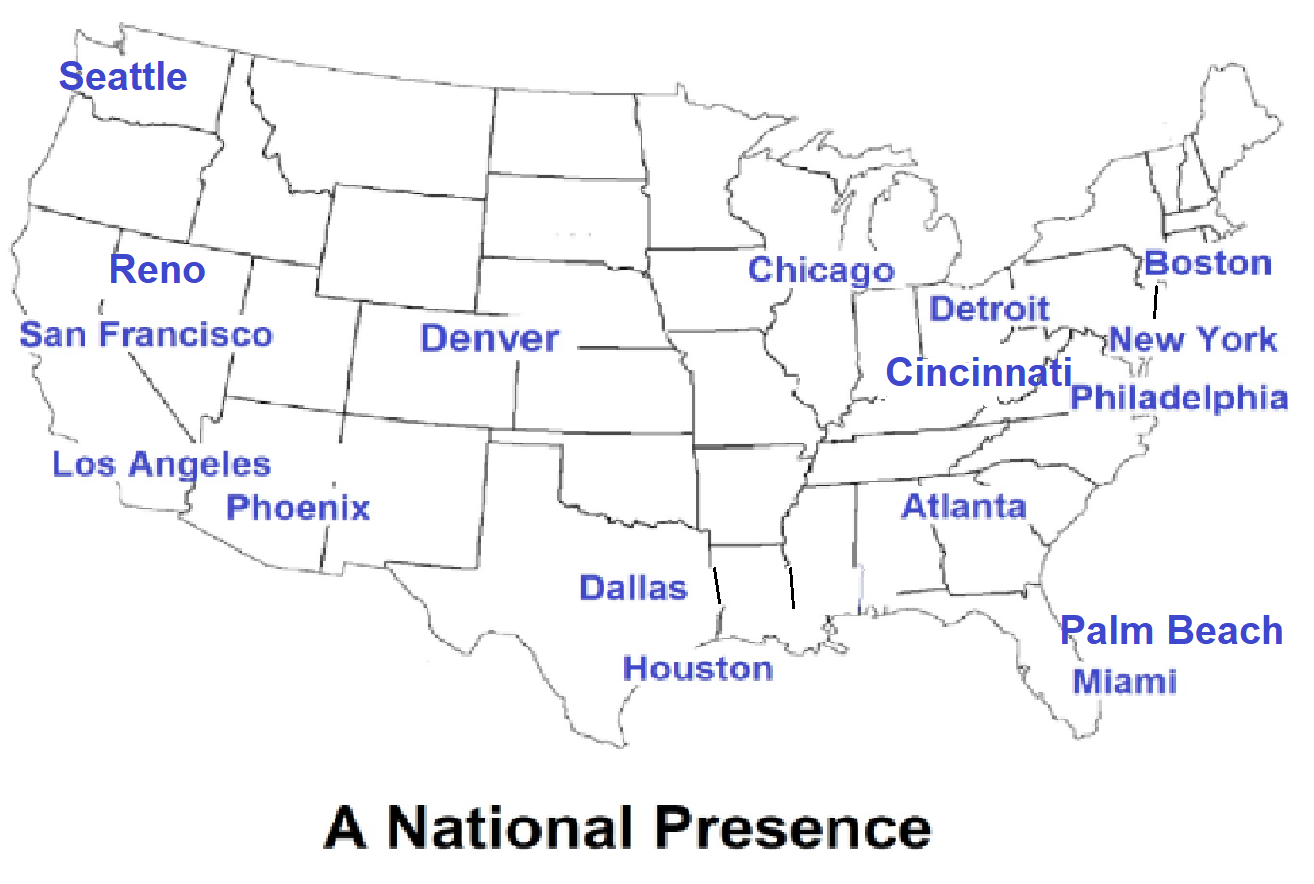

Investment Bankers / M&A Advisors - You often are approached by prospective clients that are not "ready" for the sales process. Our professionals serve as independent, expert advisors in preparing businesses for sale. The business owners/CEOs are able to complement their deep understanding of the business with independent, objective experts skilled in the functional area including operations, finance, technology, and marketing. > Learn More

Attorneys - Legal Firms are uniquely positioned as trusted advisors for their clients. Our Business Sale Preparation services are targeted to retiring Baby Boomer Business-Owners with annual revenue in excess of $5 million. These Owners have been heads-down in running their businesses for the past 20 years and are not familiar with the upcoming M&A process. > Learn More

Accounting / Consulting Firms - Accounting Firms are uniquely positioned as trusted advisors for their Private Equity and Corporate clients. We have entered into Subcontract/Referral Agreements with several national accounting / consulting firms to provide our team of senior-level professionals as staffing resources to assist them in serving their existing and potential clients. > Learn More

Family Offices - Similar to PE Firms, Family Offices may pursue add-on acquisitions for their portfolio companies. Often, the management of the portfolio companies is ill-equipped to manage a full-blown post-merger integration effort. This is where our services are able to ease the transition and help make the deal successful. > Learn More

Sellers - We assist in preparing mid-market businesses for sale, using our Deal Readiness Rating® Methodology of an initial assessment, value creation, and risk mitigation. When preparing businesses for sale, Owners/CEOs need to approach the exit strategy with the same focus and drive that helped build the businesses. Owners/CEOs who are “ready” with attractive businesses greatly increase the odds that they will find eager buyers. > Learn More

Private Companies - Today's private companies are lean. There's no such thing as extra personnel just waiting to work on a merger integration project. Yet this "hot" project won't wait. We work with the Integration Team during the initial integration project phase in small, highly experienced groups and stay involved on a part-time basis for coordination meetings, steering committee meetings or work stream updates. > Learn More

PE Portfolio Companies - As with any acquisition, add-ons pose their own challenges. Increased portfolio complexity, personnel integration, as well as portfolio strategy selection and execution, are common challenge areas encountered by PE firms. We work with the PE operating partners and the management of portfolio companies, on an as-needed basis to make the transaction successful. > Learn More

Private Equity Firms - We serve as the Operating Partner's "Go-To M&A Resource" in onboarding platform companies and integrating their add-ons. Providing a disciplined leadership structure, experienced M&A personnel, checklists, tools, and templates is especially critical so that the Operating Partner can focus on growth, efficiencies and overall corporate management. > Learn More

Public Companies - Although similar to private companies, a unique issue for public companies is that their Board of Directors is accountable to their shareholders for the success of their M&A deals. Too often, due to the failure of M&A activity, Boards are faced with shareholder litigation. By retaining our services to assist in the merger integration, the Boards may be afforded a certain level of protection against litigation by their having taken fiscally prudent proactive steps to assure success. > Learn More